Venture Financing

Raise With Confidence

Capitalize the company without compromising control or velocity. We map the round, tune the narrative and the numbers, architect the right instruments, and run a tight close — so your cap table stays clean and your deal moves fast.

The Funding Playbook

Strategy. Terms. Close.

Our four-stage playbook moves from funding strategy and investor readiness to instruments and structures, through term sheets and negotiation, and finally closing and ongoing compliance. Each step reduces risk, protects control, and shortens time-to-cash.

Strategic Finance

Design the Round

We start with the why, how much, and on what terms. We model cash needs and milestones, translate metrics into a valuation narrative, and build a dilution-efficient raise plan investors respect — and founders can live with. We also organize a data room that answers diligence before it’s asked.

- Runway & milestones with dilution scenarios

- Valuation and option pool brief (pre vs. post)

- Cap table hygiene and scenario modeling

- Data room index and Reg D/solicitation guardrails

Right Instruments

Choose the Vehicle

From pre-seed SAFEs to bridge notes and priced equity, we calibrate instruments to stage, leverage, and speed. We harmonize caps, discounts, MFN, pro rata, and information rights across investors — avoiding hidden resets and messy side letters.

- Stage-tuned SAFE/Note templates and riders

- Cap/discount matrix and conversion models

- Pro rata & information rights standardization

- Side-letter framework and MFN guardrails

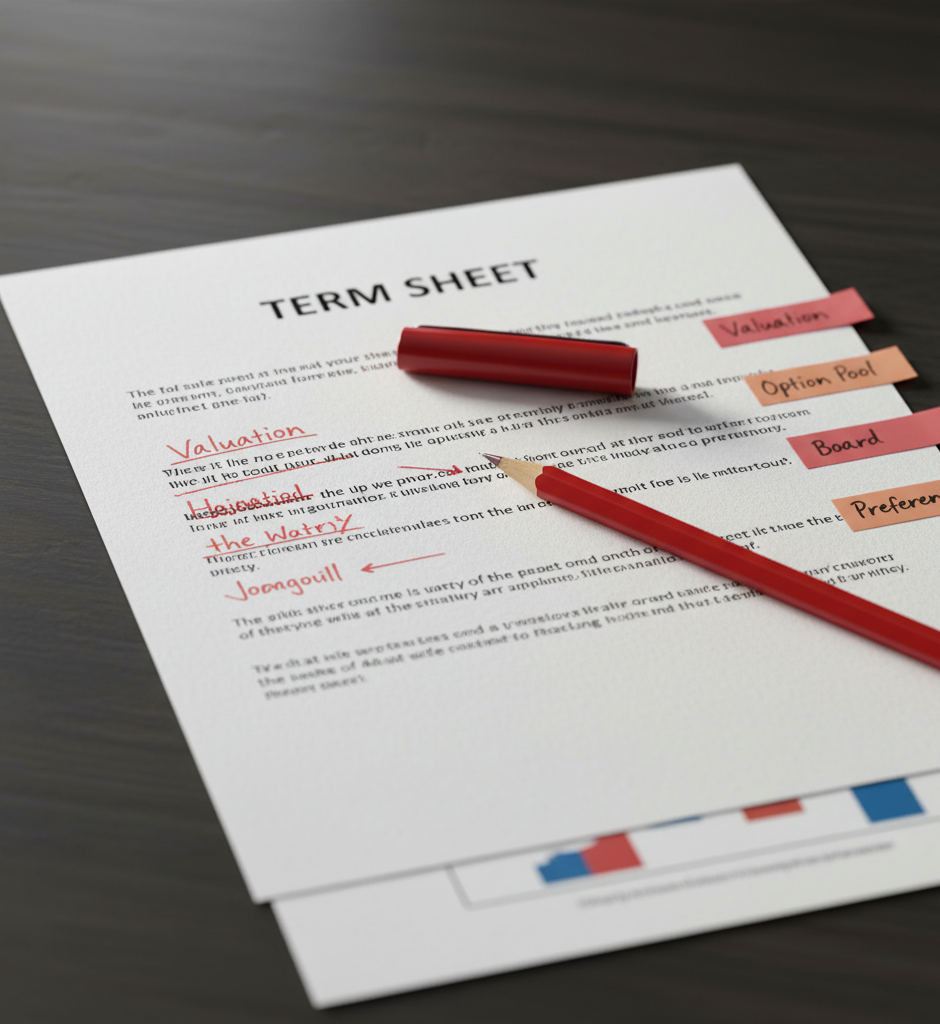

Deal Control

Negotiate What Matters

We review and negotiate term sheets with precision — aligning economics and control with your strategy. We stress-test option pool math, protective provisions, liquidation preferences, anti-dilution, board composition, and investor rights so today’s win doesn’t create tomorrow’s deadlock.

- Term sheet redlines and comparison matrix

- Economics brief: valuation, pool sizing, milestones

- Board & protective provisions calibration

- Founder equity/vesting/acceleration framework

Diligence to Cash

Execute the Close

We quarterback diligence, coordinate with investor counsel, and paper the transaction — purchase agreements, investor rights, charter amendments, and consents. We handle regulatory notices and securities filings and deliver a clean, updated cap table and closing set.

- Charter restatement; SSA/SPA; IRA; ROFR/Co-Sale; Voting Agreement

- Board & stockholder consents; opinions (if required)

- Form D/Blue Sky filings and KYC/solicitation guardrails

- Updated cap table, option pool, and closing binder